There are a few steps you need to take in order to start a business in Vermont. First, you need to choose the type of business you want to start and then register your business with the state. You will also need to get a business license from the town or city where your business is located.

Once you have all of your paperwork in order, you can begin operating your business.

- Research the type of business you want to start in Vermont

- Consider the business’s purpose, structure, and model

- Determine the best location for your business in Vermont

- Consider factors such as customer base, competition, zoning regulations, and access to resources

- Create a business plan for your Vermont business

- This should include financial projections, marketing strategies, and operational details

- Register your business with the state of Vermont and obtain any necessary licenses or permits required for operation

- Launch your business! Promote your products or services through marketing efforts and begin operating according to your plan

How to Register a Business in Vermont

If you’re thinking about starting a business in Vermont, there are a few things you need to do to get started. First, you need to choose a business structure. Will your business be a sole proprietorship, partnership, LLC, or corporation?

Once you’ve decided on a business structure, you’ll need to register your business with the Vermont Secretary of State’s office. You can do this online or by mail.

Once your business is registered, you’ll need to obtain any licenses or permits that may be required for your specific type of business.

For example, if you’re opening a restaurant, you’ll need to obtain a foodservice license from the Vermont Department of Health. Depending on your location and type of business, other licenses and permits may be required as well.

After registering your business and obtaining any necessary licenses and permits, you’re ready to start operating!

Be sure to stay up-to-date on all tax filings and requirements (both state and federal), as well as any other regulations that may apply to your businesses. Congratulations on taking the first steps towards owning your own Vermont business!

Vermont Business License

Vermont businesses are required to have a business license, which is issued by the Secretary of State. The cost of the license is $50 for a two-year period. Businesses must renew their licenses every two years.

The business license must be displayed in a prominent place within the business premises. Businesses that fail to display their license may be subject to a fine of up to $500.

Businesses are required to notify the Secretary of State within 30 days of any change in ownership or control of the business.

Changes in ownership include, but are not limited to, the sale of all or part of the business, a change in partners, and a change in directors or officers.

Vermont Secretary of State

Vermont Secretary of State Jim Condos was elected in 2010, and re-elected in 2012 and 2016. He has served as the President of the National Association of Secretaries of State (NASS) since July 2017.

Secretary Condos is a strong advocate for election security and was appointed by Governor Scott to co-chair Vermont’s Election Security Commission.

The Commission’s goal is to ensure that Vermont’s elections are secure, accurate, and transparent.

In addition to his work on election security, Secretary Condos also focuses on business services and increasing access to government data. Under his leadership, the Business Services Division has helped start over 18,000 businesses in Vermont.

The Secretary of State’s Office is also responsible for maintaining vital records, such as birth certificates and death records. These records are important not only to individuals and families, but also to businesses who rely on them for things like employee background checks.

If you have any questions about the work of the Vermont Secretary of State or need assistance with anything related to business services or vital records, you can contact the office at 1-800-439-8683 or visit their website at sos.vermont.gov.

State of Vermont Business Names

Vermont businesses are required to register their business name with the state. This is done through the Secretary of State’s office. The business name must be available for use and not already in use by another business.

The name also cannot be misleading or deceptive.

Once you have chosen a business name, you can search the Business Name Database to see if it is available. If it is available, you can register it online or by mail.

There is a $30 fee to register a business name in Vermont.

If you want to operate your business under a different name than your legal company name, you will need to file a DBA (Doing Business As) with the state of Vermont. You can do this online or by mail.

There is no fee to file a DBA in Vermont.

It’s important to choose a strong, unique business name that will help you stand out from the competition. A good business name should be easy to remember and pronounce, and it should reflect the type of business you are in.

Take some time to brainstorm ideas with friends or family members before settling on a final decision.

Vermont Llc Cost

Vermont LLC cost is relatively low when compared to other states. The minimum amount required to form a Vermont LLC is $125. This includes the filing fee and the initial LLC registration fee.

There are no additional fees required to maintain your Vermont LLC.

Vermont Secretary of State Login

The Vermont Secretary of State is responsible for the administration of elections and campaign finance laws, as well as the regulation of securities and notaries public. The office also maintains records for businesses and charities, issues birth, death, and marriage certificates, and licenses professional fundraising consultants.

In order to login to the Vermont Secretary of State website, users must enter their username and password.

Once logged in, users will have access to all of the features and services offered by the website. These include online filing for businesses, submitting campaign finance reports, registering to vote, and more.

We hope this blog post has provided you with the information you need in order to successfully login to the Vermont Secretary of State website.

Vermont Business Registration Renewal

Vermont businesses are required to renew their business registration annually. The renewal process is simple and can be done online or by mail.

To renew your business registration online, go to the Vermont Business Registration Renewal website.

You will need to enter your business name, account number, and email address. Once you have entered this information, click on the “Submit” button.

If you prefer to renew your registration by mail, download the Business Registration Renewal Form from the Vermont Secretary of State’s website.

Complete the form and return it to: Vermont Secretary of State’s Office, 128 State Street Montpelier, VT 05633-1101. Make sure to include a check or money order for the renewal fee of $25 made out to “Secretary of State”.

Vermont Business License Search

In order to start a business in Vermont, you must first obtain a business license from the state. The process for doing so is relatively simple and can be completed online.

Before beginning your business license application, you will need to have the following information on hand:

-The name of your business

-The physical address of your business

-The type of business you will be operating (e.g., retail, restaurant, service, etc.)

Credit: www.mycorporation.com

How Much Does a Business License Cost in Vermont?

In the state of Vermont, a business license costs $110 for most businesses. However, there are some businesses that require a special license, such as those that sell alcohol or offer massage services. The cost of these licenses can vary depending on the type of business.

For example, a liquor license in Vermont costs between $100 and $500, while a massage therapy license costs $50.

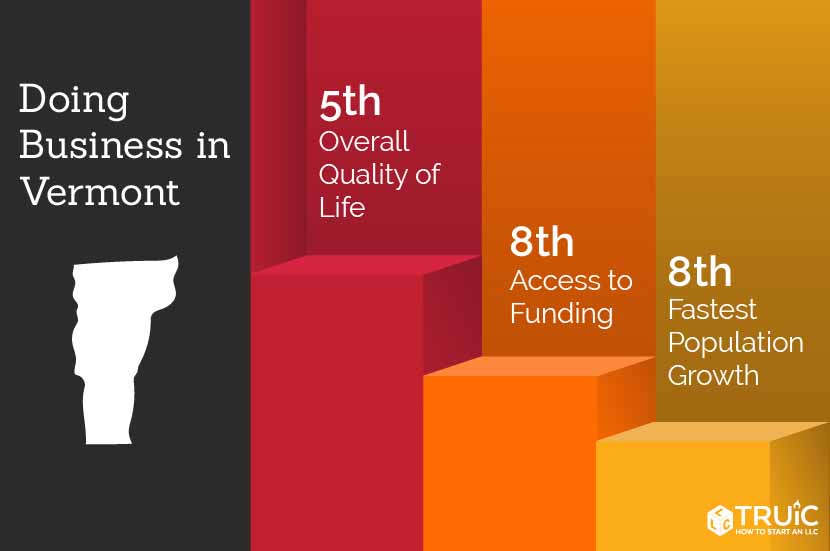

Is Vermont a Good Place to Start a Business?

Vermont is often lauded as a great place to do business. The state has a strong entrepreneurial ecosystem and supportive government policies. Additionally, the cost of living and doing business in Vermont is relatively low compared to other states in the Northeast.

All of these factors make Vermont an attractive option for businesses looking to get started.

However, it’s important to note that not all businesses will thrive in Vermont. The state has a small population (just over 600,000 people), so businesses that require a large customer base may find it difficult to grow here.

Additionally, winters can be harsh in Vermont, which can make it tough for businesses that rely on foot traffic or outdoor activities.

Overall, Vermont is a good place to start a business if you have a solid plan and are aware of the challenges you may face. The state offers plenty of resources for entrepreneurs, and its quality of life is hard to beat.

If you’re willing to put in the work, starting a business in Vermont can be a great decision.

How Much is an Llc in Vermont?

An LLC in Vermont is $100. You will need to file a Certificate of Organization with the Vermont Secretary of State and pay the $100 filing fee. The Certificate of Organization must include the LLC’s name, address, registered agent, purpose, duration and names of its organizers.

Do You Need a Business License in Vermont?

There is no statewide business license in Vermont, but some cities and towns require businesses to have a local license. The cost of a local business license varies by municipality, so you will need to check with your city or town clerk to find out the fee. Some types of businesses may also need to obtain a state professional license, such as for architects, engineers, and landscape architects.

You can find out more about professional licensing requirements on the Vermont Secretary of State’s website. If you are planning to open a restaurant, you will need to obtain a food service permit from the Vermont Department of Health.

The Complete Guide To Starting A Business In Vermont

Conclusion

Vermont offers a great opportunity for entrepreneurs looking to start a business. The state has a strong economy and is home to many successful businesses. There are a few things to keep in mind when starting a business in Vermont, including the following:

1. Choose the right location – Vermont is home to many small towns and rural areas, so it’s important to choose the right location for your business. Consider the demographics of the area and whether there is a market for your product or service.

2. Get organized – Once you’ve chosen your location, it’s time to get organized.

Create a business plan and register your business with the state of Vermont. You’ll also need to obtain any necessary licenses and permits.

3. Find funding – Starting a business can be expensive, so it’s important to find sources of funding.

There are many options available, including loans, grants, and investment capital.

4. Promote your business – Once you’re up and running, promote your business through marketing and advertising efforts.